EB1 Case Manager Training – Understanding PM-602-0005.1 – High Salary

High Salary

There are several places to find comparative data for the High Salary category.

In this section, you will be comparing our client’s salary to others in the industry. Earning an above average salary is not enough for the category – it must be significantly higher than others in the field and USCIS wants to see that the client is in the 90th percentile.

Once we establish what our client’s earnings are, we will then need to compare it to data of similar professionals in the same country where the work was done.

EB1 Case Manager / Understanding the PM

First, we will outline all of the criteria and then take them one by one and show you how to properly document the category.

(1) Determine whether the alien’s salary or remuneration is high relative to the compensation paid to others working in the field

Petitioner’s Job Description

Alien Wage Data

(a) Employment Contract

(b) Pay Stubs

(c) Recent Tax Return

(d) CPA Letter of Support (if Applicable) Outlining Remuneration Package or other Earnings

US Wage Information

(a) The Bureau of Labor Statistics (BLS)

(b) The Department of Labor’s Career One Stop website

(c) The Department of Labor’s Office of Foreign Labor Certification Online Wage Library

Home Country Wage Information

(a) Job Advertisements Equivalent to Alien’s Position in Home Country

(b) Other Wage Data Produced From Surveys or Other Comparable Source

Let’s go through each piece of evidence we will need to provide to establish this.

(1) Determine whether the alien’s salary or remuneration is high relative to the compensation paid to others working in the field

Petitioner’s Job Description

We want to make sure we have a strong job description for the client, and this may come from letters or an official document. We will use this document to correlate the client’s duties to a specific job title that is provided by the databases.

So many of our clients have very unique job titles that make it impossible to find data on that specific title, so we need to look at the data that closely corresponds to the person’s duties.

Once we have an outline of what the client does, we can do the appropriate research to find the correct comparative data, but first we must outline our client’s wages.

Alien’s Wage Data

The client’s wage data differ based on their profession, but there will be a per annum, per day, per hour, etc type of payment schedule that will outline the amount paid, and then there may also be additional income such as bonuses or cash incentives that can be used in addition to the actual salary. Please bear in mind that medical benefits and paid vacation time cannot be used to supplement the salary, even if they are assigned a financial dollar amount.

(a) Employment Contract

It is important to have a full understanding of the client’s earnings.

Not every client will have an official employment contract, but you will need to document how much the client earns and at what frequency (such as per annum, per day, per hour, etc).

For example, and oil and gas engineer may have a contract that lists a salary of $200,000 per year, with a 20% bonus each year. This gives us a frame of reference for how much the client earns. Alternatively, a music producer may work on a project basis and provide several invoices where he or she was paid $150 per hour work on a record.

Both situations will satisfy the high salary category, and once we establish how much our client is paid and at what frequency, we will need to provide evidence to establish that the client did, in fact, earn the money.

(b) Pay Stubs

Pay slips, bank statements showing deposits or cancelled checks are all ways to show that the client actually received the pay that they have been promised. You will need to speak with the client to determine how they are paid and what evidence can be provided to show that they actually received the money and that it came from working in their field of endeavor.

(c) Recent Tax Return

The tax return or end of year tax certificate (such as W2 in the US or a P60 in the UK) is clear evidence of how much the client earned and what organization paid those funds to the client.

Be careful with these documents because we cannot use combined income if the client has filed a tax return with their spouse; we must focus only on our clients earnings.

In many cases, the clients tax return may not reflect what they are currently earnings because they have gotten a raise or a bonus since filing those taxes, and that is ok. The evidence can still be provided to show a history of earnings and the argument writer will explain the difference in the evidence.

Additionally, those individuals who work on a per day or per hour rate may be high earners but may not have a high annual salary reflected in the tax return. Again, we can still provide the evidence as long as we provide the proper context for why the tax return may be different than the contractual amounts.

(d) CPA Letter of Support (if Applicable) Outlining Remuneration Package or other Earnings

For our clients who have more unorthodox methods of earnings, such as self-employed freelancers, or individuals who receive dividends from a company, we will want to get a CPA letter to support the evidence provided and provide context as to how the client earns their money and how much money they earn.

US Wage Information

If the client is currently working in the US, you will need to access the wage databases to pull the appropriate information. You will need to determine what the client does, and then find the correlating documentation from the wage databases run by the Department of Labor.

Let’s go through each one with instructions on how to pull the data. For the purposes of this exercise, let’s use a chemical engineer working Houston, Texas.

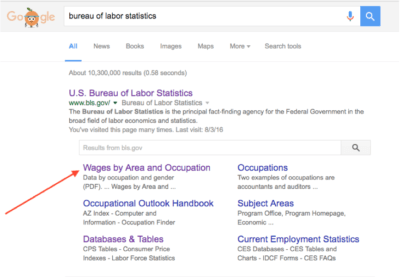

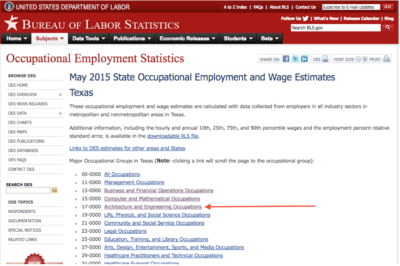

(a) The Bureau of Labor Statistics (BLS)

1.Enter ‘Bureau of Labor Statistics’ in Google and access the link titled ‘Wages by Area and Occcupation

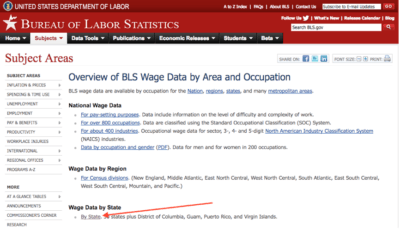

2. Select the link title ‘Wage Data by State

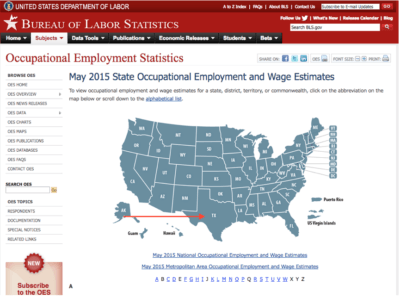

3. Select the state where the client is currently working.

4. Now we have a list of occupations. We know our sample client is a chemical engineer, so select ‘Architectural and Engineering Occupations’.

5. Now select ‘Chemical Engineer’.

6. This will give you the wage data that can be used to compare our client’s earnings. As mentioned in the introduction, our client’s earnings should surpass the 90th percentile.

As long as our clients total remuneration is higher than $157,160, then he is above the 90th percentile according to this data base. We will do the same exercise for the next database.

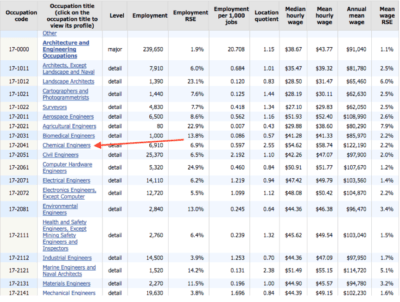

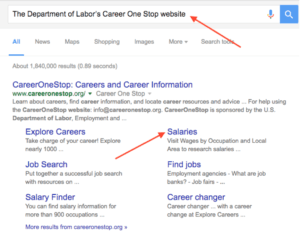

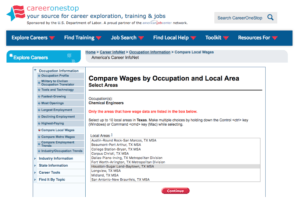

(b) The Department of Labor’s Career One Stop website

1.Enter ‘the Department of Labor’s Career One Stop website’ into Google and click on the ‘Salaries’ link.

2. Access the link for ‘Wages by Occupation and Local Area’.

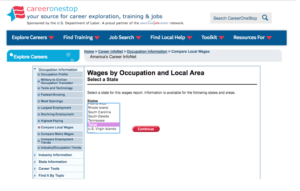

3. Remember, our example is a Chemical Engineer working in Houston, Texas, so select ‘Texas’ in this menu and click ‘Continue’.

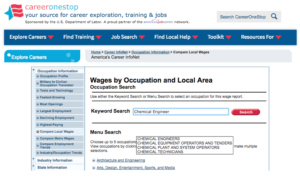

4. In the key work search field, enter ‘Chemical Engineer’ and click Search.

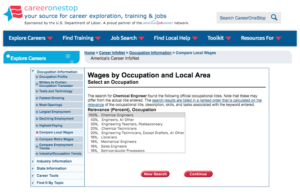

5. Selected ‘Chemical Engineers’ from the menu and click Continue.

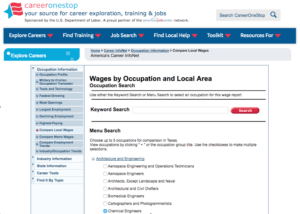

6. We don’t want to compare chemical engineers to any other occupations, so scroll down and select Continue.

—

7. This will bring up a screen with the major areas in Texas, and we want to select Houston then click Continue.

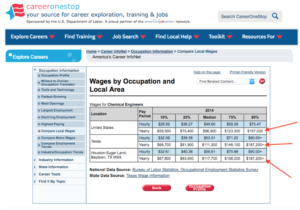

8. This brings you to a table to shows the national, statewide, and local wage data.

Ok, so let’s talk about this data for a minute because we pulled a chemical engineer in Houston, Texas for a very specific reason. USCIS specifically calls for the 90th percentile wage data and we need to show national wages. Oftentimes, the national wage will be the highest wage data available, however, in some cases, you will see that the local data is higher. This often occurs when you have a high concentration of talent in one area – such as chemical engineers (often in the oil and gas field) working in Texas or computer programmers in the Silicon Valley of California.

When you prepare the evidence, your salary should always be above the 90th percentile for the national data, but if the state or local data is higher, so should our client’s salary.

This discussion will hold when reviewing the next database, as well.

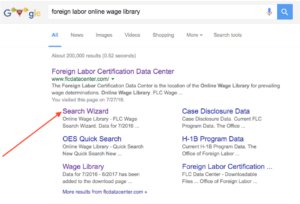

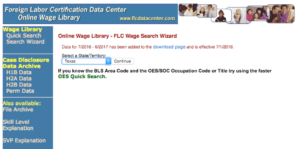

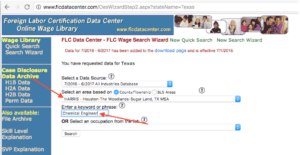

(c) The Department of Labor’s Office of Foreign Labor Certification Online Wage Library

1.Search Foreign Labor Online Wage Library in Google and select the ‘Search Wizard’ link.

2. Select the territory; in this case, we are selecting Texas.

3. From there, we will need to select the county (you may need to Google what county the city is in to ensure you have the most accurate data) as well as put in our key word search of ‘Chemical Engineer.’ From there, click the Search button.

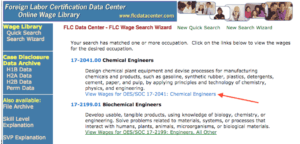

4. The search brought up two options, and in this case, we want to select the chemical engineers. Then select the link under the description.

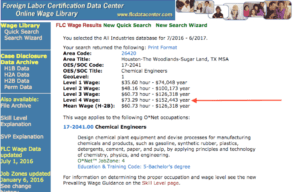

5. We are looking at the Level 4 Wage as our high earners, and this is the data we will use to compare our client’s wages.

These are the three primary governmental databases that will be used when the client is working in the United States. The client’s salary or salary package must be higher than the 90th percentile of earners in order for the argument to be approved by USCIS.

Home Country Wage Information

Many of our clients are not currently working in the United States, but rather abroad. In these cases, we must use comparative data from the country where the client is currently working. Where possible, you should do this research for the client, however, there may be times when you will need to request evidence or assistance from the client in determining the appropriate surveys or databases to use.

There are two ways to show that a client who is working abroad is earning a salary above the top earners in the country: –

– Job advertisements for equivalent positions

– Wage data from surveys or databases similar to the available US databases

(a) Job Advertisements Equivalent to Alien’s Position in Home Country

This data can give USCIS a good frame of reference to see what others working at the same level as our client could potentially earn in the specific foreign country we are researching. Obviously, this type of data does not have the scientific percentiles, but when you can find job adverts that are half or less than half of what our client makes, it show that the client is certainly earning more than others in the field.

Where possible, this data should not stand alone and should be supported by other wage databases.

(b) Other Wage Data Produced From Surveys or Other Comparable Source

When researching wage data, there are a number of sources that include data from outside of the US. These sites include, but are not limited to: –

- Payscale.com

- Salaryexplorer.com

- Salary.com

While these databases will provide you with good data, many countries also have governmental databases that provide data similar to the US. You should seek out this information – remember to use the client as a resource for determining what databases may be available – as it will carry more weight with US Immigration.

Conclusion

There are a few key points to remember when preparing the High Salary evidence: –

- Find the occupation data for the job that most closely resembles the Petitioner’s job duties

- Always compare the data at the 90th percentile or other data for those that are very top earners in the field

- Always provide data that in national in scope

- Always provide data from the country where the client earned that salary

- You are not limited to the clients’ base salary – look into their contract to see what other financial benefits and bonuses they may have received and that can be used.

By using the above tools to properly research and analyze the data, you can prepare evidence to support a very strong high salary category.

Training Videos

Part 1 – Part 2 – Part 3 – Part 4 – Part 5 – Part 6

.

Various High Salary Situations – February 23rd 2017

Part 1 – Part 2 – Part 3 – Part 4 – Part 5 – Part 6 –

Part 7 – Part 8 – Part 9 – Part 10 – Part 11 – Part 12 –

Part 13 – Part 14 – Part 15 – Part 16 – Part 17 – Part 18 –

Part 19 – Part 20 – Part 21 –

.

Practical Exercise – Print 3 Sample Arguments

As you print these, you should keep them on hand as a reference. Not only will you see the evidence that is provided, but you will see what your argument writer will be putting together on behalf of the client.

Print the following case(s):

Francois Pare

Michael Goldberg

Tariq Barkatawy

You will need to study each argument and the evidence presented. These cases were selected deliberately to give you a cross section of the types of clients we work with, as well as the various ways we can present evidence to satisfy a category. Obviously an oil and gas engineer will vary significantly from a creative director, and it is important that you are able to develop evidence to ensure all types of cases are successful.

Next we will look at the final category, Commercial Success.

Comments on this entry are closed.