DS 160 Tutorial Guide 8 of 12

Form DS 160

Part 1 Part 2 Part 3 Part 4 Part 5 Part 6

Part 7 Part 8 Part 9 Part 10 Part 11 Part 12

We hope you enjoy this comprehensive DS 160 guide. If you have any questions or concerns whatseover please do not hesitate to contact us for specific advice and direction.

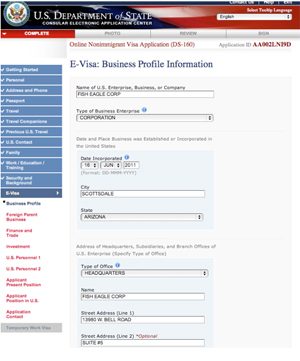

Part 8 – Form DS-160 Guide – E Visa: Business Profile

Welcome to Part 8 in this series of our DS-160 Guide

In this section we’re going to be discussing the E-Visa: Business Profile Information. Ok – complete the name of your business and then select the type of corporate entity you have incorporated.

With regards to your corporate headquarters, many small businesses do not have headquarters; that is, where one main office oversees the work of multiple locations. Thus, if your business only has one location then this location should be your headquarters.

The date of incorporation is the date when you incorporated your own company to buy or set up the business under consideration.

With regards to the question, select the “Nature of the Business”, choose the option that best describes your business – ‘General Trade’, ‘Exports from U.S.’, ‘Retail Sales’ and so on. You are then required to enter a short description of your particular business as illustrated here.

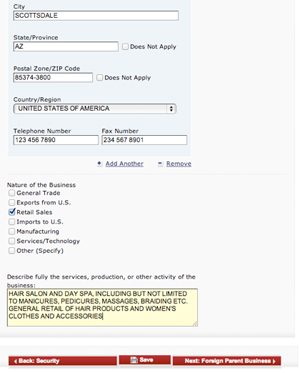

E-Visa: Foreign Parent Business Information

In the vast majority of cases, a foreign company will not own the E2 business in the US. Instead, the business will be owned by a single (or joint) investor.

Most likely you will be the foreign individual owner or investor.

When asked to enter who the foreign individuals are, then you should enter your own name. If you are in a corporate partnership then click on the “Add Another” button and then continue.

For the question “Immigration Status”, enter “Applicant”.

Your percentage of ownership cannot be less than 50%. Thus, if there are joint investors, each must have a 50% ownership in the business, unless one investor is the spouse of the principle investor.

Again, don’t forget to save your work as you go to avoid losing it.

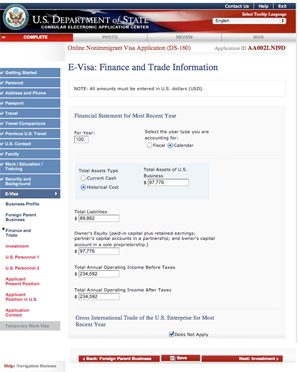

E2 Visa Finance and Trade Information

In this example, our client is buying a going concern; in fact it’s a beauty salon. Based on a review of the financial documentation provided by the Broker and whilst working with his CPA, he was able to complete the information required for this page. The financial information entered here was that of the current owner’s equity in the business and trading performance at the time.

Let’s look at Calendar Year or Fiscal Year:

Many businesses calculate their annual performance from January thru December – this is financial accounting based on a Calendar year basis. Fiscal year is where businesses calculate their performance based on the month in which the business was started. So, if the business began trading April 1st, then this business would calculate it’s performance based on the period April 1st through March 31st each year.

Owner’s Equity:

Here, Immigration is looking to ascertain the amount of the Seller’s investment in the company, as reflected in the paid-in value of the Seller’s shares in the company. In day-to-day practical terms, if the business is a sole proprietorship and a relatively small business, you can enter a nominal figure for this section, unless an accurate figure pertaining to the paid-in value of the shares can be ascertained from your CPA’s review of the financial documentation to hand. However, if finding the right numerical values becomes problematic, for example, because the Seller is not cooperating or these numbers are simply not available, then at this stage it would be better to enter nominal values in order for you to progress in the completion of this form. Some of our clients get overly stressed if they cannot answer every question to perfection; perfection is not necessary. Enter the best information you can and then if there are any questions raised by any Immigration official then explain your efforts accordingly. The Embassy official will be taking into consideration the totality of your case, not merely one line item.

Total Annual Operating Income:

Without wishing to get too technical here Operating Income is typically a synonym for earnings before interest and taxes and is also commonly referred to as “Operating Profit”. To be honest, unless you personally have an education in finance, a CPA should definitely complete this line item.

In this present case, where our client’s buying a Beauty Salon, even though the assets of the company were valued at nearly $100,000 our client, the Buyer, was able to negotiate a purchase price of $71,000.

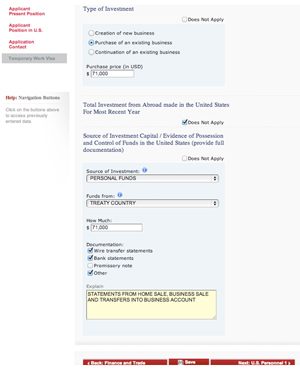

Source of Investment Funds:

The Embassy will want to know where the funds came from to buy or start your business. This form only requires you to outline the source of investment funds, but in the application bundle of documents you will need to fully detail a complete financial trail of the funds from origination to purchase or set up of the business.

E Visa Investment Information

The question regarding total investment from abroad will always be “Does Not Apply”. This question pertains only to those people who are applying for an extension and are now recording how much additional funds they have committed to the business since their original visa was approved. When answering about the source of investment funds, be as specific as possible.

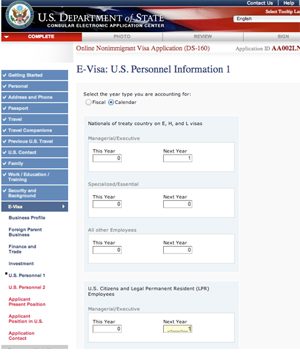

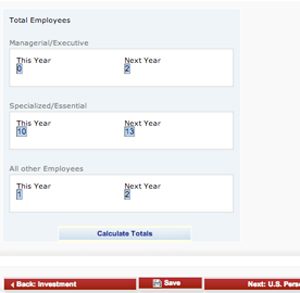

US Personnel Information 1

Managers/Executives: Here, the alien investor would only include himself, plus any other investors now applying for E2 status.

Specialized/Essential: This should be ‘zero’ in most cases, unless the E2 business is owned by a foreign company and is sending a variety of workers over, including specialists.

All Other Employees: this should be ‘zero’.

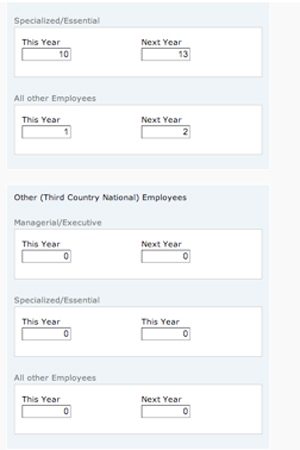

For the section relating to US citizens or permanent residents, exclude the current owners from the managerial section, but note any other employees or projected employees as laid out in your Business Plan who will be working in the business in the first year and the second year.

You should be entering ‘zero’ for third country national employees, as this is very rare.

To calculate the totals, press the “Calculate Totals” icon (it will not automatically calculate the employees until you push the icon button).

In the next presentation, we’ll continue with a further review of your business’ staffing requirements.

Immigration Law Offices of Chris M. Ingram

US Immigration Law Offices of Chris M. Ingram

Chris M. Ingram LL.M., ESQ – Immigration Attorney

Admitted in New York.

Practice Specializing in US Immigration Law

401 Wilshire Boulevard, 12th Floor,

[Cross Streets 4th and Wilshire]

Santa Monica,

California 90401

Tel: 310 496 4292

Everyday the Law Offices of Chris M. Ingram provides a comprehensive range of US Immigration expertise. We also provide a free consultation for our prospective clients.

Please note that nothing contained in this website or link therefrom shall be regarded as providing legal advice. Please contact us directly for legal advice specific to your situation. Thank You.

Specializing in the E2 Visa, EB1 Green Card, L-1A Visa and O1 Visa and K1 Visa Marriage-Based Immigration. Attorney Chris M. Ingram is dedicated to providing the very best in US Immigration legal representation. Enjoy our website.

Important Notice: Please note that all videos created by the Law Offices of Chris M. Ingram are intended as general information only and not specific legal advice pertaining your case. If you would like specific legal advice on any immigration matter please do not hesitate to contact this law office accordingly. All pictorial images used in these videos and the website in general are licensed stocked images and not portraits, or otherwise, of anyone from the Law Offices of Chris M. Ingram, nor of its clients unless otherwise indicated by name. All images are used solely for illustrative purposes only. Copyright 2010-2015 All Rights Reserved.